Freight factoring companies help trucking businesses manage cash flow. They buy unpaid invoices and provide immediate cash.

For trucking businesses, maintaining a steady cash flow is crucial. Waiting for clients to pay can be stressful and challenging. This is where freight factoring companies come in. They offer a simple solution to financial gaps. By selling your invoices, you get quick access to funds.

This helps with fuel costs, maintenance, and paying drivers on time. Understanding how these companies work can benefit your business. It can help you stay ahead and keep operations smooth. In this guide, we will explore the essentials of freight factoring companies. Learn how they can support your business and make financial management easier.

Credit: www.adcomcapital.com

Introduction To Freight Factoring

Freight factoring is a financial service. It helps trucking businesses manage cash flow. Trucking companies often face payment delays. This can create financial stress. Freight factoring provides a solution to this problem.

What Is Freight Factoring?

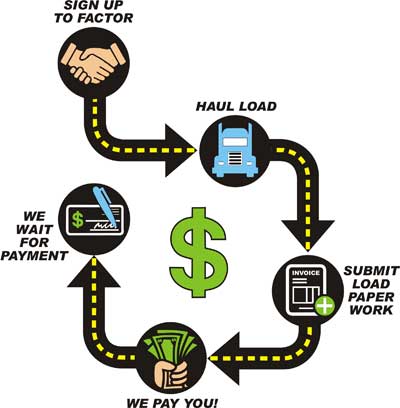

Freight factoring is a process. Trucking companies sell their invoices to a factoring company. The factoring company pays them immediately. This means trucking companies get cash quickly. They do not have to wait for customers to pay. The factoring company then collects payment from the customers. This way, trucking companies avoid waiting for long periods. They can keep their operations running smoothly.

Importance For Trucking Businesses

Freight factoring is crucial for trucking businesses. It helps maintain a steady cash flow. This is important for covering expenses. Expenses such as fuel, maintenance, and driver wages.

- Immediate Cash: Trucking companies get paid quickly.

- Reduces Financial Stress: No need to wait for customer payments.

- Improves Operations: Businesses can focus on their core activities.

- Supports Growth: Easier to expand the fleet and services.

Consider a trucking company with several outstanding invoices. Without freight factoring, they might struggle to meet expenses. With freight factoring, they get immediate cash. This helps them stay operational and grow their business. In summary, freight factoring offers a practical solution. It ensures trucking businesses have the cash they need. This allows them to keep their trucks on the road and continue delivering goods.

How Freight Factoring Works

Understanding how freight factoring works can be crucial for trucking companies. It helps manage cash flow and keeps operations running smoothly. Let’s break down the process and key players involved.

Process Overview

Freight factoring involves selling your unpaid invoices to a factoring company. This company pays you a large percentage of the invoice value upfront. The factoring company then collects the payment directly from your clients. This process gives you immediate cash flow. It helps cover expenses like fuel, maintenance, and salaries. You don’t have to wait for clients to pay their invoices, which can take weeks or months.

Key Players Involved

There are two main players in freight factoring: the trucking company and the factoring company. The trucking company provides transportation services. They generate invoices for their clients. The factoring company buys these invoices and advances money to the trucking company. Clients or shippers are also involved indirectly. They eventually pay the invoice amount to the factoring company. Effective communication among all parties ensures smooth transactions.

Benefits Of Freight Factoring

Freight factoring offers many advantages for trucking companies. It helps them manage their finances better by converting unpaid invoices into immediate cash. This service is especially helpful for small to medium-sized businesses. Let’s explore some key benefits of freight factoring.

Improved Cash Flow

Freight factoring improves cash flow quickly. Trucking companies get paid faster. They do not wait for weeks or months. This means they can pay for fuel, repairs, and other expenses on time. Better cash flow leads to smoother operations.

Reduced Financial Stress

Freight factoring reduces financial stress for trucking companies. They do not have to worry about late payments. This helps them focus on their core business. Knowing they have steady cash flow gives them peace of mind. It allows them to plan better for the future.

Choosing The Right Freight Factoring Company

Freight factoring companies can help trucking businesses manage cash flow. Selecting the right company is crucial for long-term success. This section will guide you through the essential steps to make an informed decision.

Factors To Consider

- Reputation: Check online reviews and testimonials. A company with a solid reputation is more reliable.

- Fees: Understand all the fees involved. Some companies have hidden charges.

- Funding Speed: How quickly can you get the funds? Fast funding is often crucial.

- Customer Service: Good customer support is important. You may need assistance at any time.

- Contract Terms: Look at the contract details. Ensure there are no long-term commitments unless you want them.

Questions To Ask

Before finalizing your choice, ask these important questions to ensure you’re making the best decision:

- What are your fees and rates?

- How long does it take to receive funds?

- Are there any hidden charges?

- Do you offer non-recourse factoring?

- What kind of customer support do you provide?

- Is there a minimum volume requirement?

- Can I exit the contract without penalties?

Choosing the right freight factoring company can impact your business significantly. Make an informed choice by considering these factors and asking the right questions. Your business’s financial health depends on it.

Types Of Freight Factoring

Freight factoring comes in various forms. Each type has unique benefits for different business needs. Understanding these types helps choose the best option for your company. Below, we explore two main types of freight factoring.

Recourse Vs. Non-recourse

Recourse factoring means the business remains responsible if the customer doesn’t pay. This option usually has lower fees. It is ideal for companies with reliable customers. Non-recourse factoring offers more protection. The factoring company takes on the risk of non-payment. This option can be more expensive. But it provides peace of mind.

Spot Factoring

Spot factoring allows businesses to choose specific invoices to factor. This type offers flexibility. It is great for companies needing immediate cash. It doesn’t require long-term contracts. You can decide which invoices to factor based on your cash flow needs. This helps manage finances more effectively.

Costs And Fees

Freight factoring companies offer a valuable service to trucking businesses. They provide quick cash advances against unpaid invoices. Understanding the costs and fees involved is crucial. This helps you make informed decisions and avoid surprises.

Common Charges

Freight factoring companies typically charge a factoring fee. This fee is a percentage of the invoice value. It ranges from 1% to 5% per invoice. Some companies may also charge a processing fee. This fee covers the administrative costs of handling invoices. Another common charge is the discount rate. This rate is applied to the total amount of the invoice.

Hidden Fees To Watch For

Hidden fees can catch you by surprise. Some companies charge for credit checks on customers. Others might have monthly minimum fees. This means you pay a fee if your factoring volume is low. Be aware of termination fees. These fees apply if you end the contract early. Also, look for any extra service fees. These can include wire transfer fees or late payment penalties. Always read the contract carefully. This helps you avoid unexpected costs.

Success Stories

Freight factoring companies have transformed many businesses in the logistics industry. Their services help companies manage cash flow, leading to growth and success. Let’s dive into some success stories from businesses that have thrived with freight factoring.

Case Studies

Several businesses have seen remarkable results through freight factoring. Here are some notable case studies:

| Company | Challenge | Solution | Result |

|---|---|---|---|

| XYZ Logistics | Delayed Payments | Freight Factoring | Improved Cash Flow |

| ABC Trucking | High Operational Costs | Invoice Factoring | Reduced Financial Stress |

Testimonials

Many companies have shared their positive experiences with freight factoring. Here are a few testimonials:

“Freight factoring saved our business. Cash flow issues are a thing of the past.” – John, Owner of XYZ Logistics

“We can now focus on growth without worrying about late payments.” – Sarah, Manager at ABC Trucking

Credit: hotshot-usa.com

Tips For Maximizing Benefits

Freight factoring companies provide essential services for businesses needing quick cash flow. To get the most from these services, there are several strategies you can use. Below are some tips to help you maximize the benefits of working with a freight factoring company.

Maintaining Good Records

Good record-keeping is crucial for maximizing benefits from freight factoring. Accurate and organized records allow for quick approvals. This means faster access to funds. Here are some tips for maintaining good records:

- Keep all invoices and receipts well-organized.

- Use digital tools for record-keeping.

- Ensure all customer information is up-to-date.

Maintaining good records can help you avoid disputes. It ensures you get the full value of your invoices.

Building Strong Relationships

Strong relationships with both your customers and your freight factoring company can yield significant benefits. Trust and good communication are key. Consider the following steps to build strong relationships:

- Communicate clearly with your customers about payment terms.

- Stay in regular contact with your freight factoring company.

- Resolve any disputes quickly and amicably.

Building strong relationships can lead to better terms and smoother transactions. It can also help you secure better rates and more favorable conditions. Implement these tips to get the most out of your freight factoring services. Keep your records in order and build strong relationships to maximize your benefits.

Common Myths Debunked

Freight factoring companies often face misconceptions. Many believe myths that simply aren’t true. Let’s debunk these common myths. Understand the real benefits of freight factoring.

Misconceptions

Many think freight factoring is a loan. It’s not. Companies sell their invoices for cash. There’s no debt involved. Some believe it costs too much. Factoring fees are often less than traditional loan interest rates. Others think it’s only for struggling businesses. Even successful companies use freight factoring to improve cash flow.

Truths

Freight factoring offers fast access to cash. Companies get paid quickly without waiting for invoices to be settled. It helps businesses manage cash flow better. Regular cash inflow ensures smooth operations. Factoring companies also handle collections. This means less hassle and stress for your business.

Credit: www.tetracapital.com

Frequently Asked Questions

What Is Freight Factoring?

Freight factoring is a financial service that converts unpaid invoices into immediate cash. It helps trucking companies maintain cash flow.

How Does Freight Factoring Work?

Freight factoring involves selling invoices to a factoring company at a discount. The company pays you upfront, then collects from clients.

Why Use Freight Factoring Companies?

Freight factoring companies provide immediate cash flow, reducing financial stress. They handle collections, allowing businesses to focus on operations.

Are There Fees For Freight Factoring?

Yes, freight factoring companies charge a fee, usually a percentage of the invoice value. This fee varies by company.

Conclusion

Choosing the right freight factoring company can boost your business. It improves cash flow quickly. Understand your needs and compare options. Good partnerships help your business grow. Keep these tips in mind and choose wisely. Your business deserves the best support.