DNCC Holding Tax, also known as DNCC property tax, is the yearly fee you pay to your local government for owning a home.

This money helps the government do important things in your neighborhood, like repairing roads, keeping the streets clean, taking care of parks, and making sure the sewage system works properly.

Dhaka North City Corporation (DNCC) Holding Tax

The Dhaka North City Corporation (DNCC) is in charge of managing local services in the northern part of Dhaka, which is Bangladesh’s capital city.

DNCC takes care of a large area and oversees important services like waste management, road maintenance, public facilities, and more.

When it comes to calculating holding tax, various factors come into play. These factors include where the property is situated, what type of property it is, how big it is, how old it is, and what its current market value is.

DNCC assesses each property individually to figure out how much tax it should pay based on these factors.

DNCC Holding Tax Rate

When a new house or building is constructed, modified, or developed, the responsible Revenue Supervisor in the area submits the Form to assess its tax value.

Afterward, a notice of hearing is sent to the property owner within 7 days, along with a request to provide the necessary documents as per Section 26(2) of the relevant law.

In a bold move to boost urban development, Dhaka North City Corporation has increased the property tax to TK 24 per square foot.

Additionally, a 12 percent holding tax will also be applied. This innovative tax reform is designed to enhance revenue and encourage responsible property ownership.

An important step in this taxation process occurs annually when a fixed rate of 12% tax is imposed on the determined yearly valuation of properties.

The 12% tax rate is carefully calculated based on the property’s assessed value, considering factors such as location, size, amenities, and other relevant considerations.

Read also- Personal Income Tax Rate in Bangladesh

How to Pay Holding Tax for DNCC?

Property owners in DNCC have several options for paying their holding tax. Holding tax payments can be made online through the bKash, Nagad, or Upay mobile apps by visiting the holding tax payment website.

This allows for a convenient and efficient way to fulfill your holding tax obligations.

DNCC Holding Tax Payment Online

DNCC provides an online platform that allows property owners to register their properties, calculate their holding tax, and securely make payments using digital methods.

Here’s a step-by-step guide on how to pay your DNCC Holding tax online:

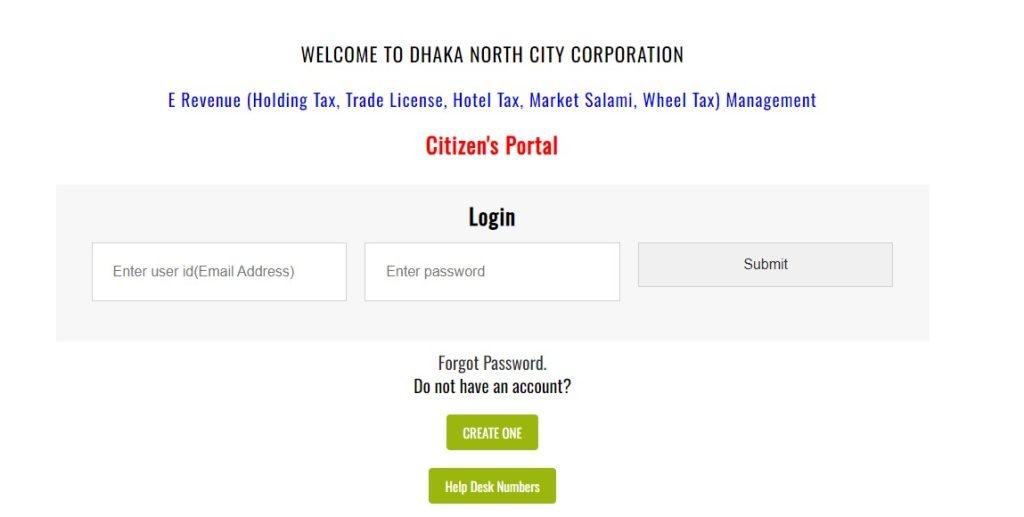

- Visit the Dhaka North City Corporation Holding Tax Payment website.

- To make your holding tax payment, log in using your user ID and password.

- If you don’t have an account, you can create one by clicking on the ‘Create Account’ button.

- After successfully creating an account, log in to the website.

- Once logged in, you will find various tax payment options.

- Choose the holding tax payment option.

- Provide all the required information accurately. You will need to enter your holding number, and the total tax amount will be displayed.

- Next, select your preferred payment method. You can pay the tax using a bank account, bKash, Nagad, or the Upay app, depending on what you have available.

- Enter your account information for the selected payment method and complete the payment transaction.

- Finally, make sure to download and save your tax payment receipt as proof of payment.

This online process offers a convenient and hassle-free way to fulfill your DNCC holding tax obligations.

FAQs For DNCC Holding Tax

Here are some FAQs about DNCC Holding Tax for additional information.

What is DNCC Holding Tax?

DNCC Holding Tax is a yearly fee that property owners in the Dhaka North City Corporation (DNCC) area are required to pay to the local government. It supports the maintenance of public services and infrastructure in the city.

How is DNCC Holding Tax calculated?

The tax is calculated based on various factors, including the property’s location, type, size, age, and current market value.

What is the deadline for paying DNCC Holding Tax?

The deadline for DNCC Holding Tax payment can vary, but it’s important to check the official DNCC website or contact local authorities for the most up-to-date information.

Can I pay DNCC Holding Tax online?

Yes, DNCC offers an online platform where property owners can register their properties, calculate the tax, and make secure payments using digital methods such as bKash, Nagad, or the Upay app.

What happens if I don’t pay DNCC Holding Tax on time?

Failure to pay DNCC Holding Tax on time may result in fines or legal consequences. It can also affect the development and maintenance of public services in your area.

How can I access my DNCC Holding Tax payment receipt?

After making a payment online, you can download and save your tax payment receipt from the DNCC Holding Tax Payment website as proof of payment.

Where can I get more information about DNCC Holding Tax rates and regulations?

You can find detailed information about DNCC Holding Tax rates and regulations on the official DNCC website or by contacting local DNCC offices.

Conclusion

Paying DNCC Holding Tax is not just a civic duty but also a crucial contribution to the development and maintenance of essential services in the northern part of Dhaka.

DNCC has made it easier for property owners to fulfill their tax obligations by offering an online payment platform.

By following the simple steps outlined in our guide, you can pay your holding tax conveniently and help support the betterment of your community.