Income Tax Return Verification Online copy is a vital document that individuals and businesses in Bangladesh must file annually with the tax authority.

This document contains a comprehensive overview of one’s income, expenses, and other pertinent financial information for a specific tax year.

Checking the income tax return status is a crucial step in ensuring tax compliance and financial planning.

Tax Return Verification

Income tax return status is a critical factor in the financial lives of individuals and businesses in Bangladesh. By keeping track of their tax return status, taxpayers can better manage their finances.

They can anticipate when they might receive tax refunds or when they need to make tax payments.

What is Income Tax Return Verification?

Income tax return status essentially refers to the condition of an individual or company’s income tax return. This status can be conveniently checked online through the National Board of Revenue (NBR) website.

Income tax returns are mandatory submissions, and their status can fall into several categories, including ‘submitted,’ ‘verified,’ ‘approved,’ ‘rejected,’ or ‘pending.’ Verifying your return status is essential to ensure you are adhering to tax laws and regulations.

Income Tax Return Verification Step-by-Step Guide

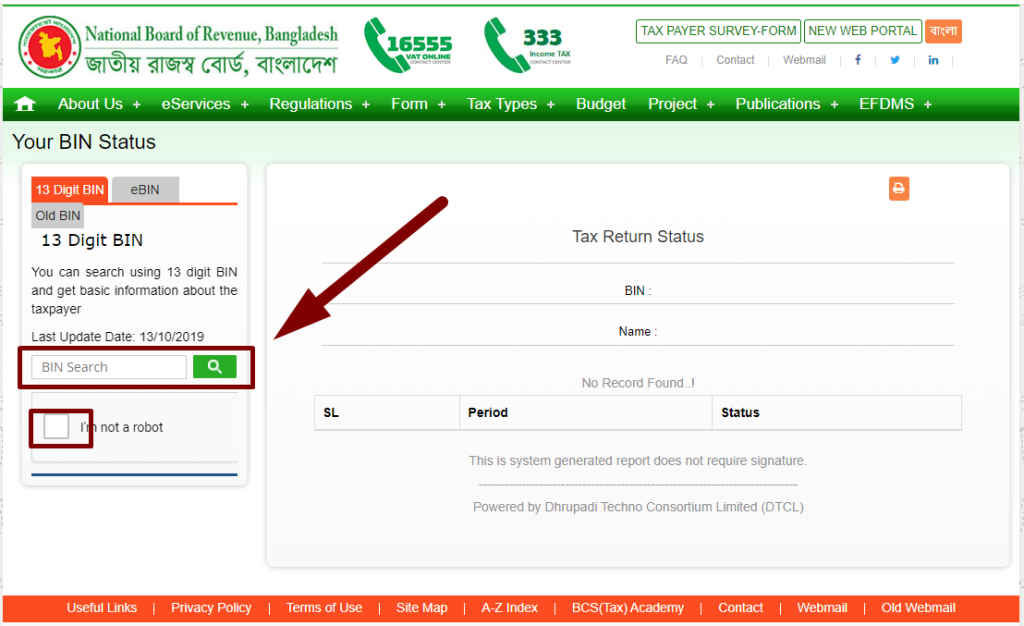

To check your income tax return status in Bangladesh, you will need a 13-digit BIN (Business Identification Number). This is required for all businesses. Follow these steps to verify your tax return status:

- Start by visiting the official website of the National Board of Revenue dedicated to income tax return status.

- On the website, you will be prompted to enter your 13-digit BIN number in the box ‘BIN Search’

- To ensure you are not a robot, complete the ‘Robot’ verification step.

- After completing the necessary information, click the ‘Search’ button.

- A new interface will appear, displaying all relevant information about your tax return status.

This includes details such as the name, serial number, and status of the tax return you filed. You can also check when the income tax was received and to which fiscal year it belongs.

Know also about Income Tax Certificate Download

The Necessity of Tax Return Status Checking

The importance of checking your tax return status cannot be overstated. In many countries, including Bangladesh, filing an income tax return is compulsory for individuals and businesses.

- Failure to do so, or submitting inaccurate information, can lead to penalties and fines.

- Thus, verifying your tax return status ensures that the tax authorities have received your return.

- It also allows you to identify and rectify any errors or omissions before the deadline.

Moreover, a tax return status check may be necessary when applying for loans, visas, or other significant documents. In summary, monitoring your tax return status is crucial for various aspects of life.

Downloading Your Tax Return Verification Copy

In many cases, it might be necessary to download the status copy of your tax return as proof.

While checking your tax status online, you will notice an option to download or print your tax return status copy. This document can be saved in PDF format or printed directly from the website.

FAQs About Income Tax Return Status

Some questions arise frequently about Tax Return Status. Here are FAQs about Tax return status.

What information will I find when checking my Tax Return Status?

When you check your tax return status, you will find information such as the name, serial number, and status of the tax return you filed. You can also see when the income tax was received and to which fiscal year it belongs.

Is it necessary to download the Tax Return Status Copy?

In many cases, it may be necessary to download the tax return status copy as proof.

You can find an option to download or print your tax return status copy while checking your status online. This document can be saved in PDF format or printed directly from the website.

What are the consequences of not filing an Income Tax Return in Bangladesh?

Failing to file an income tax return or submitting inaccurate information can lead to penalties and fines in Bangladesh. It is a legal requirement for individuals and businesses to file their income tax returns.

Can I check the tax return status for the previous year?

Yes, you can check the tax return status for previous years by providing the relevant BIN number and selecting the fiscal year of the return you want to check.

Wrapping Up

Understanding your Income Tax Return Status is essential for individuals in Bangladesh to stay informed about their tax returns and effectively plan their finances.

By consistently checking your tax return status, you can ensure that your returns are being processed accurately and any potential issues or errors are resolved promptly.