Corporate Tax Rate in Bangladesh is from 20% to 45%. The Finance Minister, AHM Mustafa Kamal, has unveiled a plan to lower taxes for companies in the upcoming budget for the fiscal year 2023-2024.

Corporate Tax Rate BD

In 2019, the Finance Act introduced a new and somewhat controversial section known as “Treatment of Disallowances” within the Income Tax Ordinance, referred to as Section 30B.

Section 30B has gained a reputation as one of Bangladesh’s more assertive and sometimes perceived unfair tax measures.

However, before delving into its intricacies, it’s essential to grasp its predecessor, Section 30, which outlines various limitations, regulations, and compliance requirements related to specific business expenditures.

One contentious issue revolves around additional benefits provided to employees, such as house rent and conveyance. If these perks exceed Tk 550,000 per year, they fall under the scrutiny of tax authorities.

What is Corporate Tax?

Corporate tax is a tax imposed on the profits earned by a corporation. This tax is levied on the company’s taxable income, which is determined by subtracting various expenses from its revenue.

These expenses typically include the cost of goods sold, general and administrative expenses, selling and marketing expenses, research and development costs, depreciation, and other operating expenditures.

In essence, corporate tax is a way for governments to collect a portion of the profits generated by companies to fund public services and government operations.

Corporate Tax Refund in Bangladesh

Bangladesh’s corporate taxation landscape is intricate, featuring various rates and regulations interwoven into its financial system.

- For companies operating in the public markets, there’s a standard tax rate of 22.5% applied to their profits.

- However, there’s a special provision for publicly traded companies that undergo an initial public offering (IPO). If they raise more than 10% of their paid-up capital through this process, they enjoy a reduced tax rate of 20%.

- Certain entities like banks, insurance companies, and financial institutions (excluding merchant banks) face a higher tax rate of 40%.

- Listed mobile phone companies are also subject to a 40% tax rate, while their non-listed counterparts and manufacturers of cigarettes and other tobacco products face an even higher tax rate of 45%.

- The majority of businesses, including private limited companies and foreign subsidiaries, are taxed at a rate of 27.5%, contributing to government revenue.

- In this financial narrative, a particular enchantment applies to transactions and sums of substantial value.

- Income, receipts, and individual transactions exceeding BDT 500,000, along with expenses and investments surpassing BDT 3.6 million, must gracefully traverse the realm of bank transfers.

Neglecting this requirement incurs a penalty and the corporate income tax rate on the taxpayer’s total income increases by 2.5 percentage points.

Corporate Tax Rate in Bangladesh Details

In Bangladesh, the corporate taxation rates vary depending on the type of company. Here is the comprehensive list of corporate tax rates in Bangladesh:

- Publicly traded companies (listed on the stock market): 25%

- Non-publicly traded companies (private companies limited by shares): 30%

- Publicly traded banks, insurance companies, and financial institutions (excluding merchant banks): 37.5%

- Non-publicly traded banks, insurance companies, and financial institutions: 40%

- Publicly traded mobile network operators: 40%

- Non-publicly traded mobile network operators: 45%

- Publicly traded cigarette manufacturers: 45%

- Non-publicly traded cigarette manufacturers: 45%

It’s important to note that companies in Bangladesh need to file their income tax returns annually, typically by the 15th of January in the year following the financial closing period, which typically runs from July to June.

Read also – Personal Income Tax Rate in Bangladesh

Private Company Tax Rate In Bangladesh

In Bangladesh, private companies play a crucial role in the economy, and understanding the applicable tax rates for different entities is essential for compliance and financial planning.

Here are the tax rates for various types of private companies in Bangladesh:

- Private Educational Institutions (Universities, Medical Colleges, Dental Colleges, Engineering Colleges, ICT Education Colleges): These institutions are subject to a tax rate of 15% on their income.

- Association of Persons: The tax rate for associations of persons is 27.5%, but non-compliance can lead to an increased rate of 30%.

- One Person Company (OPC): OPCs are subject to a tax rate of 22.5%, but non-compliance may result in the rate being raised to 25%.

- Tax Rates on Tobacco Producing Companies: Companies engaged in the production of tobacco items such as cigarettes, bidi, chewing tobacco, and gul are subject to a tax rate of 45%, with an additional 2.5% surcharge.

- Tax Rates on Mobile Operator Companies: Publicly traded mobile operator companies are taxed at a rate of 40%, while non-publicly traded mobile operator companies face a tax rate of 45%.

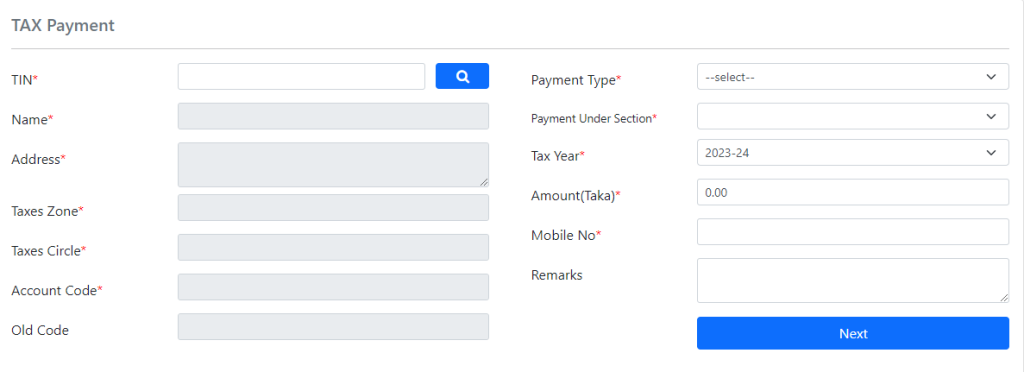

Corporate Tax Payment Method in Bangladesh

Filing corporate tax in Bangladesh involves a series of steps and requirements. Here’s a general overview of the process:

- The tax year in Bangladesh runs from July to June, with corporate tax returns due by January 15th of the following year.

- Make sure your company has a Taxpayer Identification Number (TIN) from the National Board of Revenue (NBR).

- Gather financial statements, profit and loss statements, balance sheets, and other documents for deductions and exemptions.

- Consider hiring a tax consultant or accountant familiar with Bangladeshi tax laws.

- Use the IT-11B form available on the NBR website.

- Provide accurate details about income, expenses, deductions, and credits.

- Determine your tax liability based on your business type and income.

- Include all necessary documents, like financial statements and receipts, with your tax return.

- File your tax return and documents either online through the NBR Tax Payment portal or physically at a tax office.

- Use electronic funds transfer (EFT), bank drafts, or other approved methods to pay what you owe.

- After filing and paying, obtain an acknowledgment receipt from the tax authorities.

- Keep your records organized and accessible in case of audits or assessments.

FAQs

Follow the frequently asked questions and learn answers for additional information.

When is the deadline for filing corporate tax returns in Bangladesh?

The deadline for filing corporate tax returns in Bangladesh is typically on or before the 15th of January in the year following the end of the tax year, which runs from July to June.

Do I need a Taxpayer Identification Number (TIN) to file corporate tax in Bangladesh?

Yes, having a Taxpayer Identification Number (TIN) is a prerequisite for filing corporate tax in Bangladesh. You must obtain a TIN from the National Board of Revenue (NBR) if your company does not already have one.

How can I calculate my corporate tax liability in Bangladesh?

Corporate tax liability is calculated based on the applicable tax rate for your business type and income. Accurate financial statements, profit and loss statements, balance sheets, and supporting documents are essential for the calculation.

What documents do I need to submit with my corporate tax return in Bangladesh?

You should attach supporting documents such as financial statements, vouchers, receipts, and any other relevant records to your tax return.

Can I file my corporate tax return electronically in Bangladesh?

Yes, corporate tax returns can typically be filed electronically through the National Board of Revenue (NBR)’s online portal. However, physical submission at designated tax offices is also an option.

What payment methods are available for corporate tax in Bangladesh?

Corporate tax payments can be made through electronic funds transfer (EFT), bank drafts, or other approved payment methods.

What should I do if I get audited by tax authorities in Bangladesh?

If you are audited by tax authorities, ensure that all your records and documentation are well-organized and readily available. Cooperation with the audit process is essential.

Last Words

Navigating the corporate tax landscape in Bangladesh requires careful planning, compliance with deadlines, and a thorough understanding of the applicable tax rates and regulations.

Filing corporate taxes is a vital financial responsibility for businesses in the country, contributing to the nation’s economic progress.

Seeking professional guidance and staying updated on tax laws and changes are essential steps in ensuring smooth tax compliance.