Holding Tax in Bangladesh updated information is here. In rural areas, holding tax rates range from a minimum of 1% to a maximum of 7%.

It is determined by the annual value of a house.

On the other hand, the rate of holding tax in urban areas is as high as 12%. This includes a 7% holding tax, 2% clean tax, and 3% road light tax.

However, this tax rate may be lower or higher based on location. Below is the step-by-step process of how you will calculate holding tax according to the size of your house.

Holding Tax in Bangladesh

Before paying holding tax we need to have a clear understanding of what is holding tax. Because the tax we pay to the government must have a specific reason.

It is important to have a clear understanding of why and how we are going to pay taxes to the government.

You buy land with your own money, build your house on that land, and live there. But you have to pay a certain amount of tax to the government every year for this homestead or house.

The government of the country in which you build your home and live in it has to pay taxes based on the size and location of your home. And this is holding tax.

What is the Holding Number?

Before paying the holding tax, it is important to have the holding number because we pay the holding tax by referring to the holding number.

Usually, every house has a number plate. It can be a municipality or city corporation.

Every house has a number mentioned on the number plate. And this is the holding number. You must mention this holding number when you go to pay tax. This is proof of your house tax payment.

What to do If You Do not Have a Holding Number?

We know that a holding number is required to pay holding tax. But if there is no holding number, what to do?

If you do not have a holding number, you should go to your city corporation or municipal or union council office and apply for a holding number.

If applying for a holding holding number in the city corporation or municipality, he has to pay a maximum fee of 10 thousand taka.

The holding number is usually issued within 90 days after payment of fee. On the other hand, if you apply for a holding number in the Union Parishad, the fee in this case is less than half.

So if you don’t have a holding number, first you need to apply for a holding number to pay the holding tax.

Application Procedure for Holding Number

If you don’t have a holding number, if you are in an urban area, you need to apply for a holding number under the municipality or city corporation.

On the other hand, if you live in a village, you have to go to the Union Parishad and apply for the holding number.

You will need some documents to apply for a holding number. For example-

- A white paper is required to apply.

- Along with the application form you may need your house title deed and land tax receipt if applicable.

- DCR and Namjari letters may also be required.

- If it is a Rajuk plot, in that case, the Rajuk office’s name notification will be required.

Apply for a holding number and submit the above documents to your nearest Union Parishad or Municipal office.

Currently, everything is being digitalized so if you go directly to the Union Parishad or Municipal office and apply for the holding number, they will arrange for you to apply online.

In this case, you must carry your national identity card, photograph, and the above documents.

For holding tax you have to pay the fee through treasury challan according to your area under the local tax officer.

Holding Tax BD Calculation Method

Details about holding tax and holding number are given. Now let’s know the method of calculation of holding tax. To know how to calculate, read the following information very carefully.

In the case of urban areas, holding tax is not calculated in the same way as in rural areas.

In the case of urban areas, holding tax is generally calculated in feet. Generally holding tax is payable at the rate of 6.50 TK per sq ft.

On the other hand, holding tax in rural areas is calculated as a percentage of the annual value. Now let us know about the method of calculation of holding tax of sabar area and village area.

Holding Tax Calculation in the Rural Areas

If you live in an urban area then this point is for you. At this point, you can see how you will calculate the holding tax for your house.

So let’s start the calculation.

Suppose you have a flat house of 500 square feet somewhere in Dhaka city. If you pay tax at the rate of TK 6.50 per sq ft, your total tax on your 500 sq ft house will be (500 x 6.50) = TK 3250. This is your monthly tax.

But if you want to pay annual i.e. 12 months of tax at once then your ten months holding tax will be calculated. Because two months of tax is waived by the government.

Generally, the house owner has to spend a lot of time on various renovations of the house, for which two months of tax has been waived by the government.

In this case, you will have to pay ten months of tax. Then if you multiply each month’s tax by 10, your total tax comes to (3250 x 10) = 32500 Tk.

But remember, you don’t have to pay taxes monthly or annually.

Holding tax is payable every three months. If we multiply your total annual income by four, you will get your taxes for each of the three months. In this case, your tax every three months will be (32500 / 4) = 8125 taka.

So you have to pay TK 8125 as holding tax on your house every three months.

As per the original measurement of your house, you will get the amount of holding tax by multiplying those square feet in place of the above square feet.

But another thing to note in this case is that if you live in your own flat then you don’t have to pay 40% tax.

If your tax amount appears to be too high after the tax calculation, you will need to file an appeal under your municipal council of review. In that case, your holding tax can be waived up to a maximum of 15%.

Union Parishad Holding Tax: Residential House Tax

So far I know how holding tax is determined in urban areas. Now I will know how to determine the holding tax in the Union Parishad. Union Parishad holding tax is not generally calculated in feet.

A minimum of 1% to a maximum of 7% is calculated on the annual gross value of the home you own.

The amount of holding tax varies depending on the location of your homestead. In that case, the holding tax is as low as 1% for low-value properties and as high as 7% for relatively good properties.

Before determining the holding tax, you need to visit the Union Parishad according to your location to find out about it because there is no clear provision about the holding tax of the Union Parishad.

It should be calculated according to your location.

Rules for E-Holding Tax Payment

We know details about holding tax. Now the main issue is how we pay the holding tax. Holding tax can be paid in two ways. One is by directly visiting your union parishad or municipal tax office, the other is online.

You can pay your holding tax either way. In case of payment of holding tax, you have to go directly to your municipality or Union parishad tax office to inform them about your holding tax payment.

In this case, they will provide you with a form. You have to fill in your details on this form and pay the amount as per their instructions. Then your holding tax will be paid.

If you want to pay holding tax online, you can do it from home.

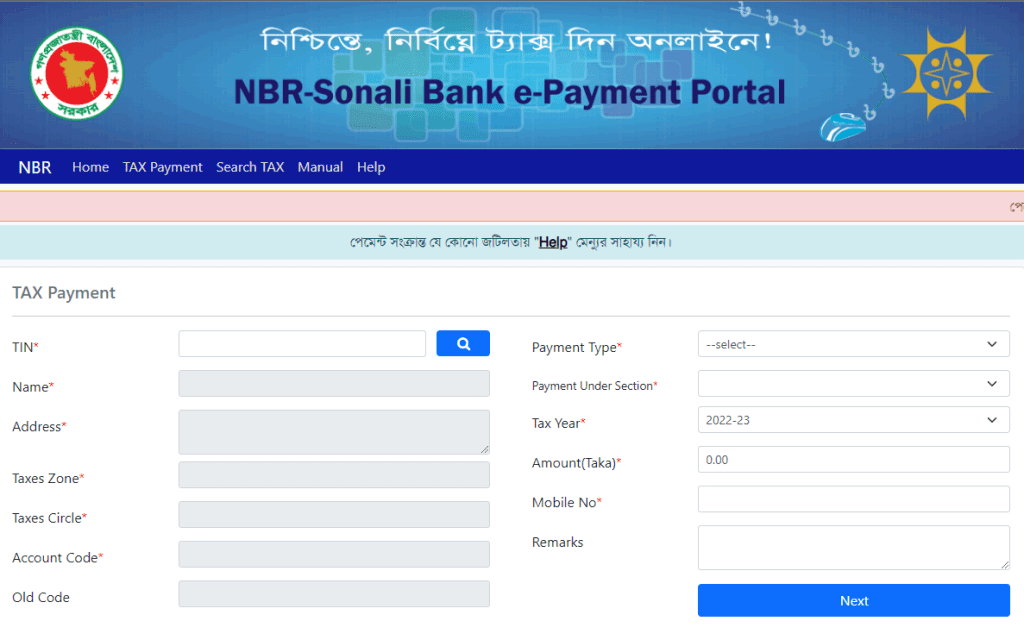

- If you want to pay holding tax online then you need to first login to Sonali Bank ePayment Portal website.

- This is Sonali Bank’s online tax payment portal.

- Here you can make the tax payment by running the Sonali Bank treasury.

- You must fill this form with the correct information.

- Here you have to provide your TIN, Name, Address, Tax, Zone Tax Circle, Account, Code Payment, Right Payment, Under Section, Tax Year, Amount, and Mobile Number correctly and go to the ‘Next’

- Then the payment option will show here.

- You can also pay this tax through your mobile banking like Bkash, Nagad, and Dutch Bangla Mobile Banking.

- Once the tax is paid, download and print the tax payment receipt. Because it can be used as evidence for you later.

By researching and reviewing all the information related to holding tax in Bangladesh, we have tried to present it here nicely.

FAQs About Holding Tax in Bangladesh

Here are some frequently asked questions and answers related to Holding Tax in Bangladesh.

What is holding tax in Bangladesh?

Holding tax in Bangladesh is a local property tax levied on homeowners, which is payable annually. The amount is determined based on the size and location of the property.

How is holding tax calculated for properties in urban areas?

In urban areas, holding tax is typically calculated based on the square footage of the property.

The rate is approximately Tk 6.50 per square foot. You can calculate your holding tax by multiplying the square footage of your property by this rate.

What are the components of the holding tax in urban areas?

Holding tax in urban areas includes three components:

- 7% Holding Tax

- 2% Clean Tax

- 3% Road Light Tax

What are the rules for paying Holding tax in urban areas?

You have the option to pay holding tax either annually or quarterly. If you choose to pay it annually, you would calculate 10 months’ worth of tax (since the government waives two months for possible renovations).

What percentage of holding tax do properties in rural areas pay?

In rural areas, the percentage of holding tax varies, ranging from a minimum of 1% to a maximum of 7% of the annual gross value of the property. The specific rate depends on the location of your homestead.

How do I find my holding number, and why is it important?

Every property should have a holding number displayed on a number plate, typically issued by the municipality or city corporation. The holding number is crucial for paying holding tax, as it serves as proof of your tax payment.

What should I do if my property does not have a holding number?

If your property lacks a holding number, you should visit your city corporation, municipality, or union council office to apply for one. The application fee is typically around Tk 10,000 for city corporations, while it is less for Union Parishads.

How do I apply for a holding number?

The application process for a holding number depends on whether you live in an urban or rural area. You may need documents like a white paper, house title deed, land tax receipt, DCR, and Namjari letters, or notifications for Rajuk plots.

Can I pay my holding tax online?

Yes, you can pay your holding tax online. To do so, you need to visit Sonali Bank’s ePayment Portal website. Fill in the necessary details, provide your TIN, and complete the payment.

You can also use mobile banking services like Bkash, Nagad, and Dutch Bangla Mobile Banking to pay your holding tax online.

Are there any opportunities to appeal or lower my holding tax?

If you believe your holding tax amount is too high, you can file an appeal with your municipal council or review authority. In some cases, you may be eligible for a reduction of up to 15% of your holding tax.

Last Words

Holding tax in Bangladesh is a property tax that varies based on location and property size.

Whether you live in an urban or rural area, understanding the process of calculating and paying your holding tax is essential to ensure compliance with local regulations.

If you encounter any challenges or need further information, feel free to leave a comment, and our team will assist you in navigating the process.

how to calculate holding tax if have Loan against the house

Dear visitor, Having a loan against your property doesn’t directly impact the holding tax calculation. The holding tax is based on the property’s assessed value, not on the outstanding loan amount. It should be calculated in the normal method.