Any student from 18 to 30 years old can open an Islami Bank student account.

To open a student account, you have to spend only 100 TK. To spend 100 TK, this money should be kept as a deposit in his account.

A free ATM Visa card is provided to the customer within a few days of opening the student account.

In this presentation, you will learn about Islami Bank student account benefits, opening rules, account tenure, etc.

IBBL Student Account

As a student, there is no alternative to the Islami Bank Student Account for money transactions and small savings.

Because Islami Bank offers maximum benefits for student accounts. Any student between the ages of 18 to 30 years can use the Islamic Bank account completely free.

Those who study from far away and it difficult to transact money regularly from home can use the Islami Bank Student Account.

Currently, it is possible to pay fees for any study, exam fee, form fill, etc. through a bank account.

Therefore, if you are a student, you can open a student account of Islami Bank and use the services of Islami Bank. But remember that you can use this account as a student account in Islami Bank up to the age of 30 years.

Benefits of Islami Bank Student Account

Students show more interest in Islami Bank mainly because of all the facilities that Islami Bank provides for student accounts.

Compared to other banks, Bangladesh Islami Bank is ensuring maximum service for student accounts. Below are the points that Islami Bank is offering for student accounts:

- Islami Bank provides completely free bank management for student accounts.

- To open an Islami Bank student account, you need to deposit only 100 taka.

- There is no custom to pay for money transactions in the Islami Bank Student Account. However, if more than the specified amount of money is transacted, then the government duty may be charged.

- Islami Bank offers free ATM visa cards for student accounts. In this case, the customer can withdraw money from any ATM booth in the country or abroad. However, the customer may have to pay a charge of Tk 15 while withdrawing money from any booth with a Visa logo.

- Through the Islami Bank Student Account, mobile can be recharged anytime and a fund transfer facility is available anywhere.

- Islami Bank student account has a free SMS facility. You can easily check your student account information through SMS.

- Islami Bank Student Account can be used for payment of any education-related fees.

- As a student between 18 and 30 years of age, bank account management is completely free.

Islami Bank Student Account Opening Conditions

There are several conditions for opening an Islami Bank student account. These are provided by the Islamic Banking Authority. If one wishes to open a student account in Islami Bank then the following conditions must apply-

- The customer must be a student and a citizen of Bangladesh.

- As a student, he has to verify the authenticity of the student from his institution i.e. in this case a certificate issued by his institution is required.

- Those who are 18 years or older can manage their accounts themselves.

- But those who are below 18 years of age should manage this account by their guardian.

Documents Required for Opening Islami Bank Student Account

When you open an Islami Bank student account you will need some documents. Whether you open an Islami Bank student account online or at a branch, you must provide the following documents:

- Certificate issued by the head of the institution studying as a student. In the case of an NID card then certificate is not required.

- Two copies of passport size color attested photographs.

- If the student is below 18 years of age then two copies of his/her guardian’s photo will be required.

- Photocopy of NID card. Photocopy of online birth registration if no NID card.

Islami Bank Student Account Opening Rules

Let’s go to the main discussion in this episode. Know everything about Islamic Bank, Now we are talking about how to open a student account in Islamic Bank. Islami Bank Student Account can be opened mainly in two ways.

One is by visiting your nearest branch, the other is through the CellFin app.

If you do not face any problems, you can open a student account in Islami Bank very easily by going directly to the branch and filling out a form. Below are both methods.

Rules for opening an Islami Bank student account by going directly to the branch

If you don’t want the online hassle, you can directly go to your nearest Islami Bank branch with the above documents.

- Go to the Islami Bank branch and go to the help corner to find out from them what you need to do in case you want to open an Islami Bank student account.

- In this case, work according to the instructions given to you by the officer working at the desk. In this case, they will provide you with a form.

- Check your documents very carefully and submit the form along with the required documents to them. In this case, you have to deposit 100 TK. Deposit that amount along with it.

- Then wait there for a few minutes. After a few minutes, your student account will be opened in Islami Bank.

- Your account will be activated shortly after opening the student account. You will then be issued the ATM Visa card within a few days.

Islami Bank student account Opening online

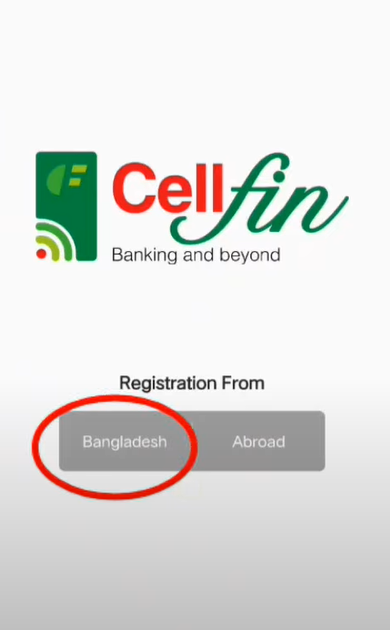

Now let’s know how to open an Islami Bank student account online. Online means it is mainly done through the CellFin app.

This, however, is a time-consuming matter. If you don’t want to go to the branch and open an Islami Bank student account, you can open it at home. For this follow the instructions given below-

First step – Registration

- First of all, go to the Play Store from your mobile and install the CellFin app.

- After installing the Cellfin app, you have to open it first and register it.

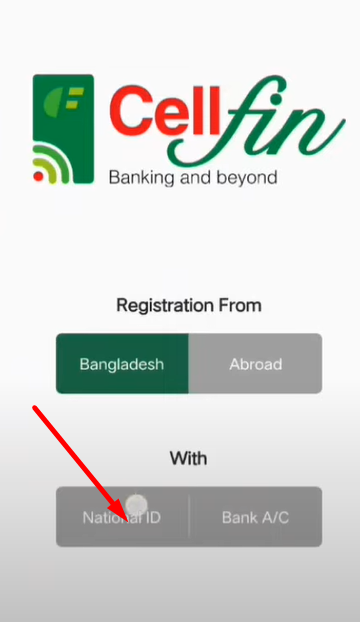

- To register you need to provide your mobile number and set up a password.

- Then click on the ‘Next’ button.

- After doing this your mobile number will be verified on the next page.

- A code will be sent to your phone, enter this code here and click on the ‘Submit’ button.

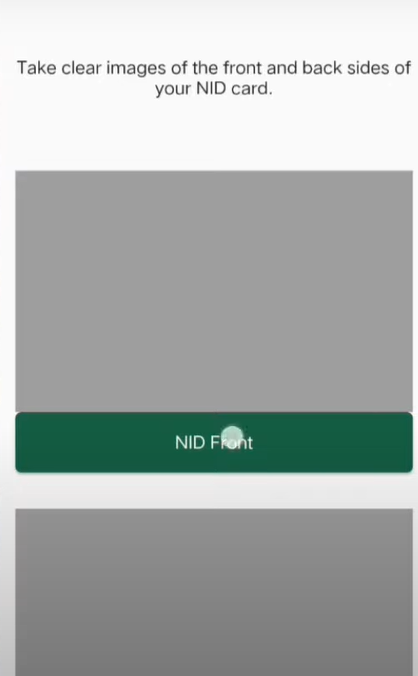

- After doing this, you need to upload scanned images of both sides of your NID card.

- In this case, remember that the image size should not exceed 100 KB. Above 100 KB it will not support here.

- Once the NID card image is uploaded, click on the ‘Next’ button.

- Then on the next page, you have to provide some information.

- Here you have to provide various information including address, gender, and occupation.

- Here all information must be given in English.

- After providing this information press the ‘Next’ button.

- On the next page, you need to upload your scanned image.

- Even if you don’t have a scanned image, you can upload your image directly from here.

So if you have a scanned image then upload it here. And if not then there will be an option to take pictures. Clicking on it will open your camera.

- Provide a fresh photo of you fully exposed. But care should be taken that the image size is not too large.

- On the next page, you have to give your name, email ID, and a referring mobile number.

- After giving them click on the ‘Next’ button and your app registration will be completed.

Second step – Account Open

In the second step, you have to open an account. Once the registration is done, enter the Selfin app with your mobile number and password.

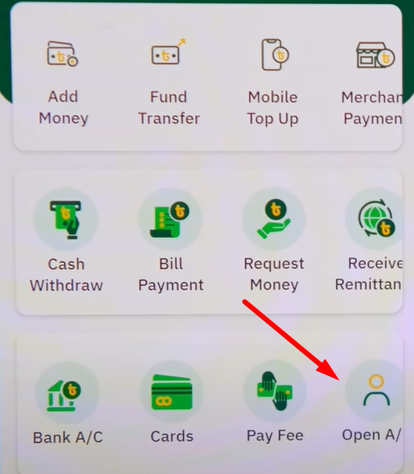

- Then click on the ‘Open A/C’ option from the home screen.

- Clicking here may require you to enter your password again.

- So put your setup password here and press the next button.

- Here several forms will appear to provide some information.

- Fill the information in that form very well.

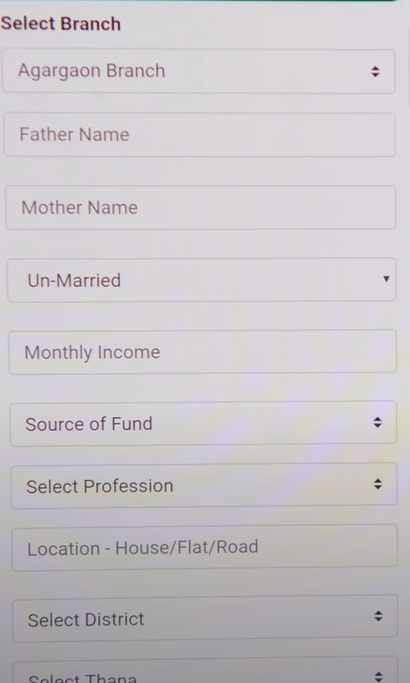

- Here you have to select the ‘Branch’ option from which branch you want to open an Islami Bank student account.

- Always try to select a branch near you.

- Then fill in the information and click on the ‘Confirm’ button.

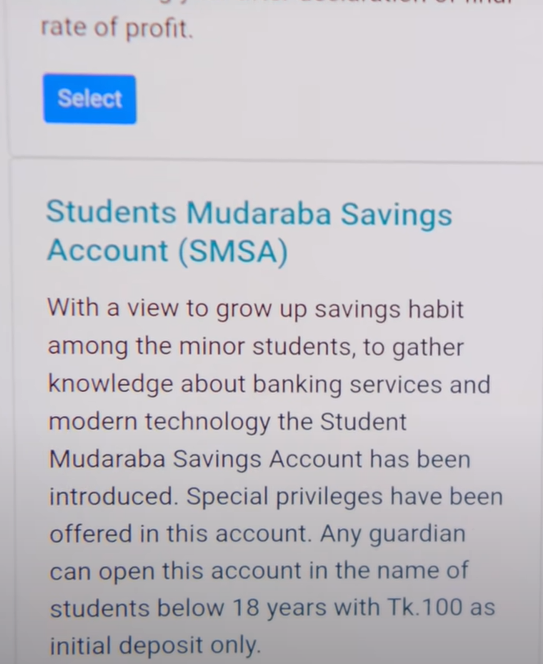

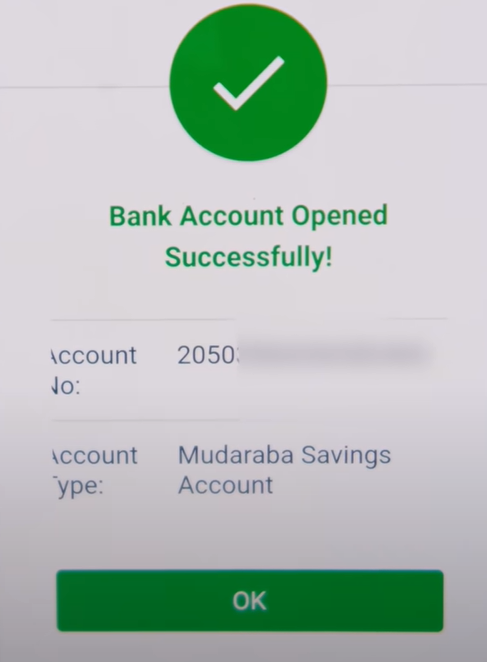

- On the next page, select the option that you will get as a student account named ‘Student Mudaraba Savings Account’

- Finally, click on the ‘Next’ button.

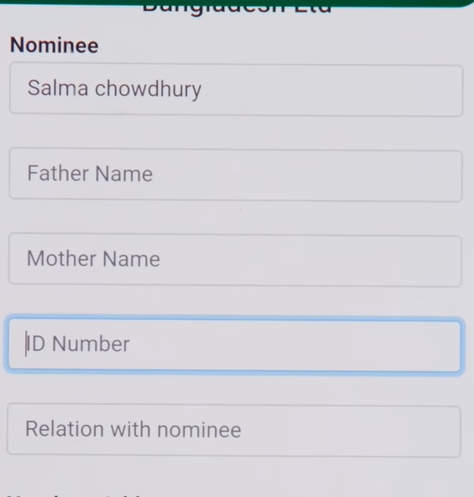

- On the next page, you have to provide your ‘Nominee Information’

- Here the nominee’s information along with his scanned photograph and NID card photograph should be uploaded.

- Then click on the ‘Confirm’ button to complete your account creation.

If cross mark comes here after confirmation then there is nothing to fear here.

This means that the images you uploaded are too large. So resize them again to less than 100 KB and re-upload and submit.

Transaction limit of Islami Bank Student Account

A common question of many students is how much money can be transacted in an Islami Bank student account after opening it.

- It is very difficult to say how much money you can trade up to because it will depend on your profession.

- Your transaction limit will be set depending on the profession you are engaged in after becoming a student.

- You need to know the transaction limit in your Islami Bank student account by going to the branch from which you will open it. In this case, they will inform you.

FAQs For Islami Bank Student Account

Follow the frequently asked questions below to learn more information about the Islami Bank Student Account.

What is an Islami Bank Student Account?

Ans: An Islami Bank Student Account is a specially designed bank account for students that follows Islamic banking principles. It provides financial services tailored to the needs of students.

Who is eligible for an Islami Bank Student Account?

Ans: Typically, students who are enrolled in educational institutions can apply for an Islami Bank Student Account. The eligibility criteria may vary, so it’s best to check with the bank for specific requirements.

What are the key features of an Islami Bank Student Account?

Ans: The key features may include a low initial deposit requirement, a debit card, online banking facilities, and the absence of interest (riba) in account transactions.

Can I use my Islami Bank Student Account for online banking and mobile banking services?

Ans: Yes, many Islami Bank Student Accounts offer online and mobile banking services, allowing you to manage your account conveniently from anywhere.

Are there any fees associated with an Islami Bank Student Account?

Ans: Fees may vary depending on the bank’s policies. Some banks offer fee-free accounts for students, while others may have minimal charges for certain services.

How do I open an Islami Bank Student Account?

Ans: To open an Islami Bank Student Account, you typically need to visit your nearest branch of Islami Bank with the required documents, which may include your student ID, proof of identity, and proof of address.

Can I get a debit card with my Islami Bank Student Account?

Ans: Yes, many Islami Bank Student Accounts come with a debit card that allows you to make purchases and withdraw cash from ATMs.

Are there any restrictions on the type of transactions I can perform with this account?

Ans: Generally, there are no restrictions on the types of transactions you can perform with an Islami Bank Student Account.

How can I check my account balance and transaction history?

Ans: You can check your account balance and transaction history through online banking, mobile banking apps, ATMs, or by visiting the bank’s branch.

Final Words

In today’s presentation, I have tried to present all the correct information about the Islami Bank Student Account. Hope you have cleared all the confusion about Islami Bank.

If you have any queries regarding the Islami Bank Student Account then you can inform us through the comment section. Hope to get a reply soon.