Personal Income Tax in Bangladesh focuses on individuals’ earnings and is a widely used taxation method.

It covers various income sources, including salaries, self-employment, property rentals, investment returns, capital gains from asset sales, and retirement income like pensions.

Income Tax BD

Personal Income Tax in Bangladesh, or Income Tax Bangladesh, is the tax system for income in Bangladesh. It’s a direct tax on earnings by individuals, businesses, and others in the country.

Individuals present for 182 days or more in the financial year. Individuals present for 90 days or more in the financial year, if they were present for 365 days or more in the previous 4 years.

This tax rate ranges from 0% to 25%. The specific personal income tax amount is established each fiscal year through the Finance Act.

Bangladesh Personal Income Tax Rate

As outlined in the Finance Act of 2023, the income tax rates for various entities are structured as follows:

- The initial Tk 3,50,000 of gross income is taxed at 0%

- The subsequent Tk 1,00,000 of gross income is taxed at 5%

- The following Tk 3,00,000 of gross income is taxed at 10%

- The next Tk 4,00,000 of gross income is taxed at 15%

- The next Tk 5,00,000 of gross income is taxed at 20%

- For the above 5,00,000 of gross income, the tax rate is 25%

There are variations in the personal income tax rates for specific citizens:

- Female and male taxpayers aged 65 years and above have a tax-exempt income limit of Tk.4,00,000.

- Third-gender taxpayers and disabled taxpayers enjoy a tax-exempt income limit of Tk.4,75,000.

- Gazetted war casualties benefit from a tax-free income limit of Tk 4,75,000.

- For each child/pet of a parent or legal guardian of a disabled person, the tax-free income limit is Tk.50,000 or higher. If both parents of the disabled person are taxpayers, one can claim this benefit.

- Non-resident individual taxpayers are subject to a tax rate of 30% on their gross income.

How To Pay Income Tax Online?

Income tax serves as a pivotal revenue source for government-led development initiatives, making it obligatory for all salaried individuals.

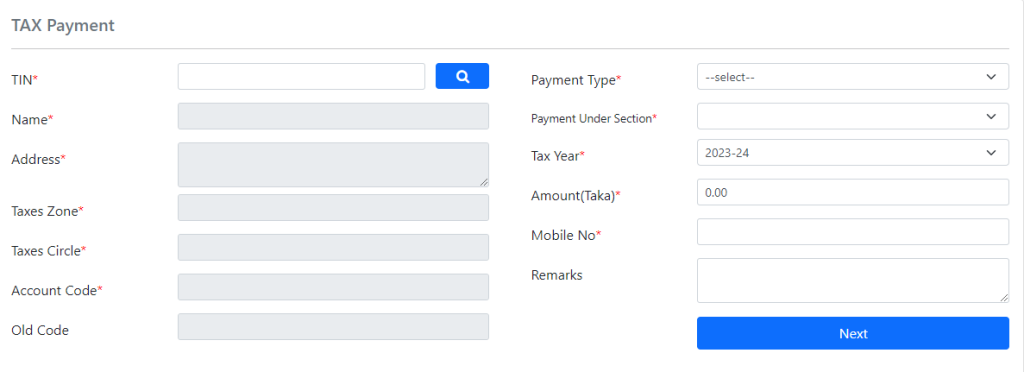

If you find the prospect of income tax payment daunting, the online payment system might change your perspective. Here’s a straightforward guide to make online income tax payment hassle-free:

- Start by visiting the official e-payment platform of the NBR Tax Payment

- A form will pop up; complete it with essential details such as your name, address, tax zone, tax year, and mobile number.

- Then, hit the ‘Next’ button.

- Proceed to the subsequent step where you’ll choose your preferred payment mode – either Debit Card or Mobile Banking.

- Once your chosen payment method is selected, furnish the requisite payment details along with the specified amount.

- Finalize the payment process accordingly.

- Upon successful payment, you’ll receive a confirmation receipt.

To download your income tax return certificate, visit Income Tax Certificate Download Online

FAQs About Personal Income Tax in Bangladesh

Here are provided some frequently asked questions and answers about Income Tax in Bangladesh.

Why is income tax important for individuals?

Ans: Income tax serves as a vital source of revenue for government activities and national development. It’s mandatory for salaried individuals to contribute to their country’s progress.

How can I make the income tax payment process easier?

Ans: The online payment system streamlines the income tax payment procedure. By following the steps outlined in the guide, you can conveniently fulfill your tax obligations.

Where can I access the official e-payment platform for income tax?

Ans: You can access the National Revenue Board’s (NRB) official e-payment website by clicking on this link: https://nbr.sblesheba.com/.

What information is required to complete the payment form?

Ans: You’ll need to provide details such as your name, address, tax zone, tax year, mobile number, and other relevant information to complete the payment form.

How do I proceed after filling out the payment form?

Ans: After completing the form, click the “Next” button. You’ll then need to choose your preferred payment mode – either Debit Card or Mobile Banking.

How can I finalize the payment process?

Ans: Once you’ve chosen your payment method, provide the necessary payment details and the specified amount. Follow the prompts to complete the payment.

Will I receive confirmation of my payment?

Ans: Yes, upon successful payment, you will receive a receipt confirming the completion of the transaction.

Conclusion

Incorporating online methods for Personal Income Tax in Bangladesh payment streamlines the process, ensuring timely contributions to national development.

By utilizing the official e-payment platform and following the outlined steps, individuals can navigate tax obligations with ease, contributing to a more efficient and effective financial system.